Alley-Cassetty and Zap Data Hub

- social4951

- Mar 21

- 4 min read

Background

For over a century, Alley-Cassetty has built its reputation on quality products and reliable service. However, as the business expanded and operations became more complex, the company faced growing challenges in managing financial data and reporting. With multiple cost centers spanning two separate companies, financial reporting had become an increasingly difficult and time-consuming process.

The finance team relied on manual processes that involved pulling data from various systems, consolidating it in spreadsheets, and generating static PDF reports. This approach resulted in delays, inconsistencies, and a lack of real-time insights, making it difficult for decision-makers to respond swiftly to changing business conditions. Recognising the need for a more sophisticated solution, Alley-Cassetty began exploring options for modernising its data management and analytics capabilities. The goal was to replace manual reporting with an automated system that would not only save time but also improve accuracy, accessibility, and strategic decision-making.

After evaluating several options, Alley-Cassetty chose to implement Zap’s data automation and analytics platform, which promised seamless integration with their existing SYSPRO ERP system.

Challenges Faced

Before implementing Zap, Alley-Cassetty encountered several operational hurdles that slowed down financial reporting and decision-making:

Time-consuming manual reporting – Monthly financial reports took an entire week to prepare, requiring finance staff to extract data manually and consolidate information across multiple cost centers.

Limited data accessibility – Executives and department heads received static PDF reports that lacked interactive features, making it difficult to drill down into financial insights or analyze trends.

Outdated and inconsistent data – The reliance on static queries and spreadsheets meant that reports did not automatically update when new warehouses or product lines were added, leading to discrepancies in reporting.

Inefficient sales commission reporting – The finance team spent three full days calculating sales commissions manually, followed by additional weeks of reconciliation and adjustments.

Lack of real-time insights – Business leaders had to make critical decisions based on outdated data, limiting their ability to respond quickly to financial trends and operational changes.

"I was underwater. It took me a full week to prepare financials, and even then, the reports weren’t digestible or actionable."

-Bill Westman, Chief Financial Officer, Alley-Cassetty

Solution Outcomes

To address these challenges, Alley-Cassetty implemented Zap’s data automation and analytics platform, seamlessly integrating it with their SYSPRO ERP system. The solution delivered a range of key benefits:

Automated financial reporting – Reports that previously took a full week to compile are now generated in real-time, reducing administrative burden and improving accuracy.

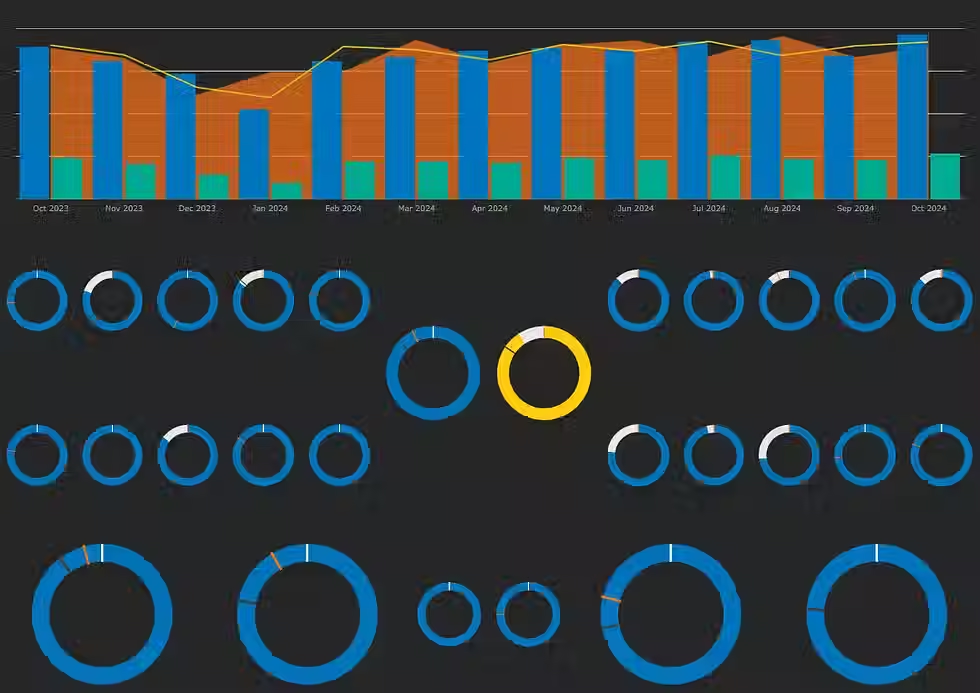

Interactive dashboards – Leadership teams now have instant access to key financial and operational data via dynamic, interactive dashboards that allow for deep analysis and real- time decision-making.

Automated sales commission reports – What once required three days of manual effort is now calculated and distributed automatically by the second day of each month, significantly improving efficiency and accuracy.

Exception-based reporting – Real-time alerts flag unmapped GL accounts and other data inconsistencies, ensuring that reports are fully accurate before they are shared with stakeholders.

Enhanced accounts receivable tracking – The finance team now receives automated reports on overdue payments, allowing them to proactively manage credit risk and improve cash flow.

A More Dynamic Solution In Action

A key example of Zap’s impact was on sales commission reporting, a historically time-intensive process. Previously, Bill Westman, CFO, would spend three days manually extracting and reconciling data. If discrepancies were found, the process would take even longer, delaying financial reporting.

With Zap’s automation, by the morning of the second day of the month, the report is ready without any manual intervention. This shift has freed up valuable time, ensuring accuracy and reducing stress across the finance team.

Another example is proactive credit management. Before Zap, managers were often caught off guard when customers were placed on credit hold. Now, with automated alerts 15 days in advance, teams can act preemptively, securing payments and preventing business disruptions.

Additionally, Alley-Cassetty’s finance team has been able to reallocate time saved from manual data entry to more strategic activities, such as forecasting, budgeting, and financial planning. The automation of routine tasks has enabled the company to shift its focus from merely reporting past results to proactively shaping the future.

Outcomes & Competitive Advantage

The implementation of Zap delivered transformational results for Alley-Cassetty:

90% reduction in reporting time – Monthly financials that previously required a week of effort are now completed at the click of a button.

100% data accuracy – Automated exception reporting ensures complete data integrity, reducing errors and inconsistencies.

Faster decision-making – Executives can now review up-to-date financial performance every morning, allowing for agile and informed decision-making.

Sales efficiency gains – The ability to track dormant customers through automated reports has empowered the sales team to proactively re-engage past clients and drive revenue growth.

We wake up every morning to real-time insights instead of scrambling through outdated reports.

-Patrick Spear, Chief Operating Officer, Alley-Cassetty

Seamless Integration & Scalable Growth

One of the most significant advantages of Zap was its ease of implementation and scalability:

No IT team required – With no internal IT department, Alley-Cassetty found Zap’s user-friendly interface intuitive, allowing the finance team to self-manage reports and dashboards.

Customizable and flexible – The CFO and finance team can now build and modify reports on demand, tailoring insights to specific business needs.

Future-proof analytics – Alley-Cassetty is leveraging Zap’s predictive analytics capabilities to develop models for inventory planning, customer retention, and operational optimization.

Looking Ahead - Future Vision

With Zap’s successful implementation, Alley-Cassetty is now looking to expand its analytics capabilities:

Predictive inventory management – Using AI-driven analytics to anticipate product demand, helping to optimize stock levels and reduce excess inventory.

Deeper sales insights – Refining customer segmentation and sales forecasting for more personalized engagement and targeted growth strategies.

Operational efficiency improvements – Exploring automation in fleet management and logistics to enhance delivery efficiency and reduce costs.

Conclusion

By implementing Zap, Alley-Cassetty has transformed its financial reporting process from a labor-intensive, manual task into an automated, real-time decision-making system. The company now operates with greater confidence, efficiency, and insight, positioning itself for continued success and growth in an increasingly competitive market.

Before Zap, reporting was a painful, manual process. Now, we have real-time data at our fingertips, allowing us to move faster and make smarter decisions.

- Bill Westman, Chief Financial Officer, Alley-Cassetty